Discover how a bimodal integration strategy can address the major data management challenges facing your organization today.

Get the Report →Publish Reports with TaxJar Data in SAP Crystal Reports

Use the Report Wizard to design a report based on up-to-date TaxJar data.

Crystal Reports has many options for offloading data processing to remote data; this enables real-time reporting. With the support for JDBC in Crystal Reports, the CData JDBC Driver for TaxJar brings this capability to Crystal Reports. This article shows how to create a report on TaxJar data that refreshes when you run the report.

Refer to the given table for the tools and their versions used in this article:

| Application Name | Version |

|---|---|

| SAP Crystal Reports 2020 | SP3 |

| JDBC Driver | 23.0.8565 |

Deploy the JDBC Driver

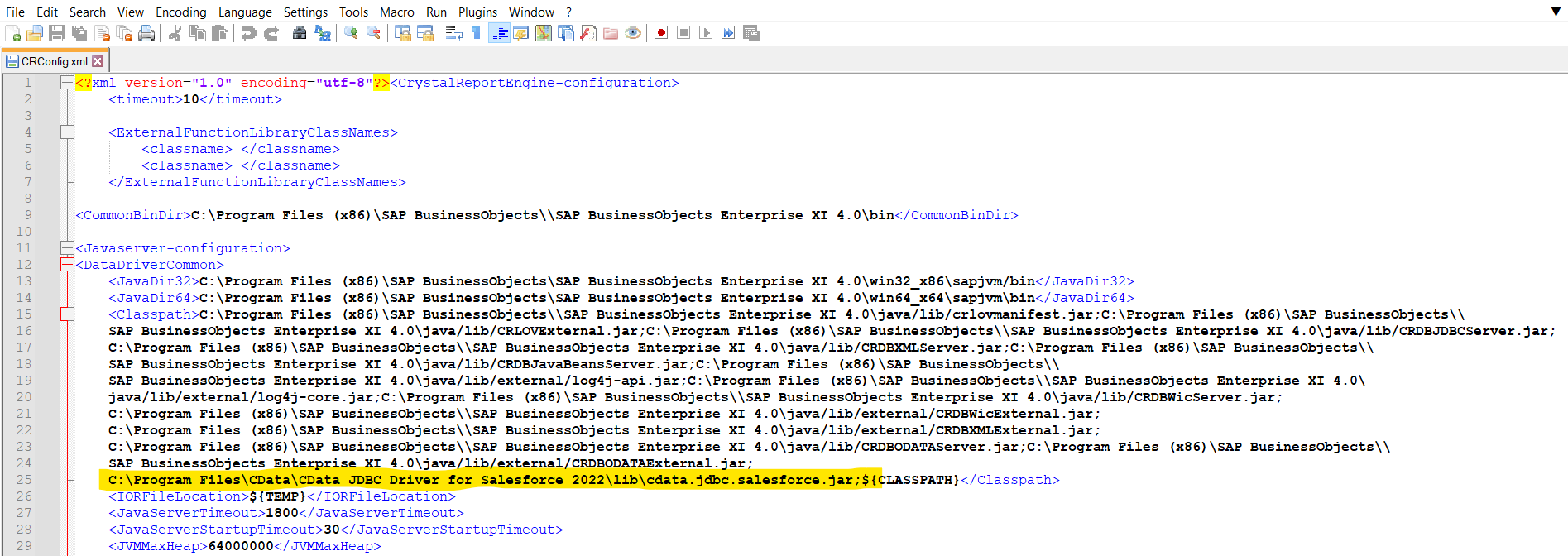

Install the CData JDBC Driver for TaxJar by including the driver JAR in the Crystal Reports classpath: Add the full file path, including the .jar, to the paths in the ClassPath element under the DataDriverCommonElement.

The default location for the CRConfig.xml file is C:\Program Files (x86)\SAP BusinessObjects\SAP BusinessObjects Enterprise XI 4.0\java — the path might be slightly different based on your installation. The driver JAR is located in the lib subfolder of the installation directory.

After you have added the JAR to the ClassPath, restart Crystal Reports.

Connect to TaxJar Data

After deploying the JDBC driver for TaxJar, you can use the Report Wizard to add TaxJar data to a new report.

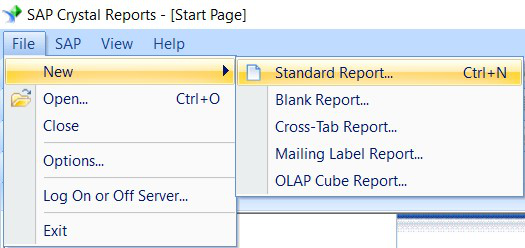

- Click File -> New -> Standard Report.

![Create a standard report. Create a standard report.]()

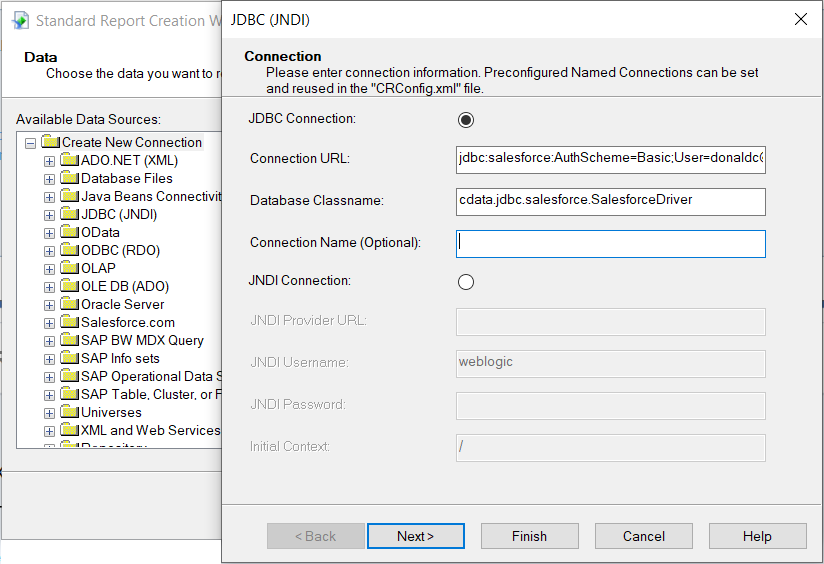

- Expand the JDBC (JNDI) under Create New Connection and double-click Make a New Connection.

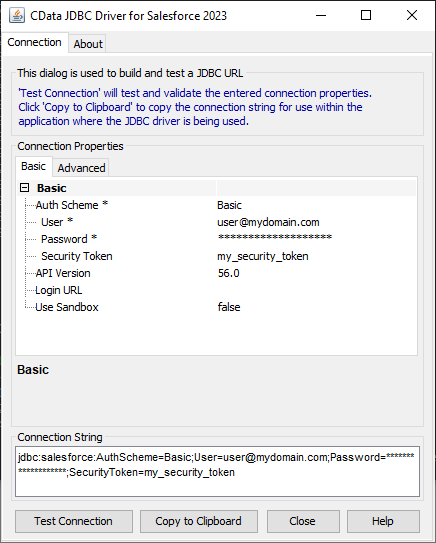

- Create a connection string using CData JDBC Driver for TaxJar.

- By default, the CData connector will retrieve data of the last 3 months in cases where the entity support date range filtering. You can set StartDate to specify the minimum creation date of the data retrieved.

- If the API Key has been created for a sandbox API account please set UseSandbox to true, but not all endpoints will work as expected. For more information, refer to the TaxJar developer documentation.

In the wizard, enter the JDBC connection URL:

jdbc:taxjar:APIKey=3bb04218ef8t80efdf1739abf7257144;Set the driver class name:

cdata.jdbc.taxjar.TaxJarDriver![Create a new JDBC (JNDI) Connection Create a new JDBC (JNDI) Connection]()

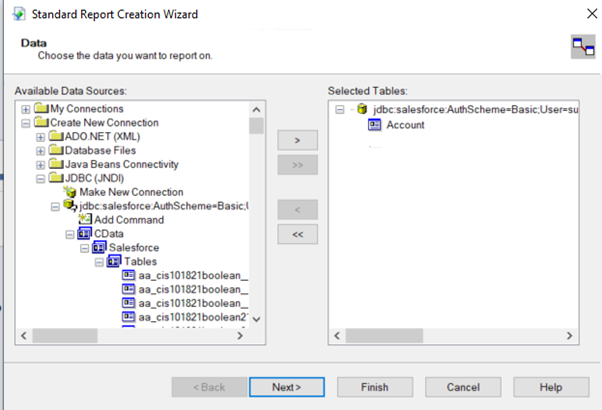

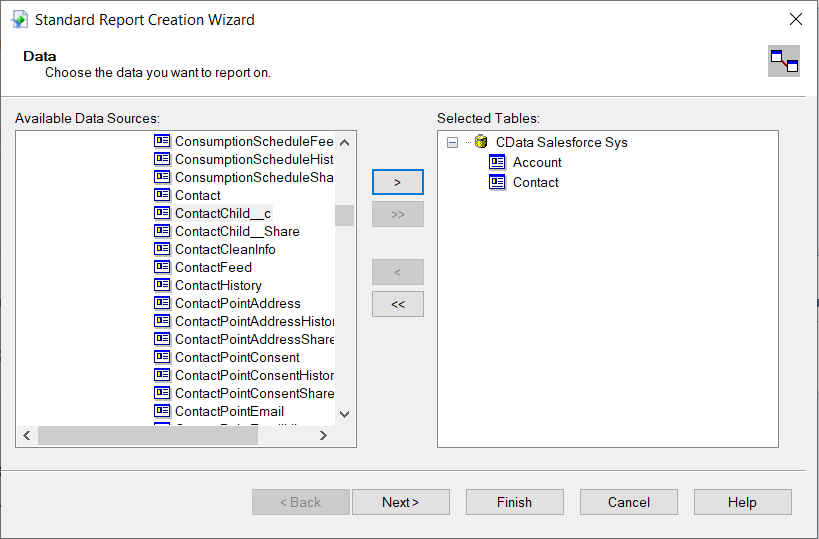

- Select the tables needed in the report.

![Add the table. Add the table.]()

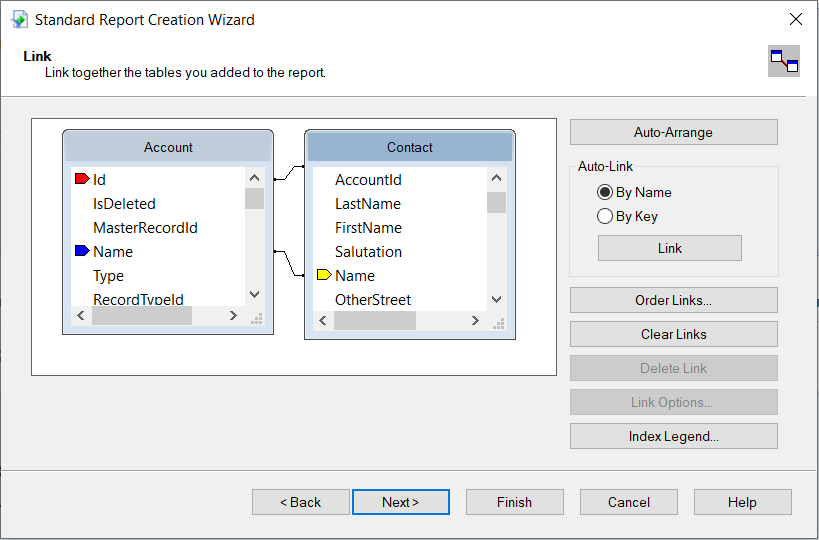

- You can also link tables from the TaxJar data in SAP Crystal Reports. Click on NEXT after adding the links between tables.

![Add multiple tables. Add multiple tables.]()

![Link the tables. Link the tables.]()

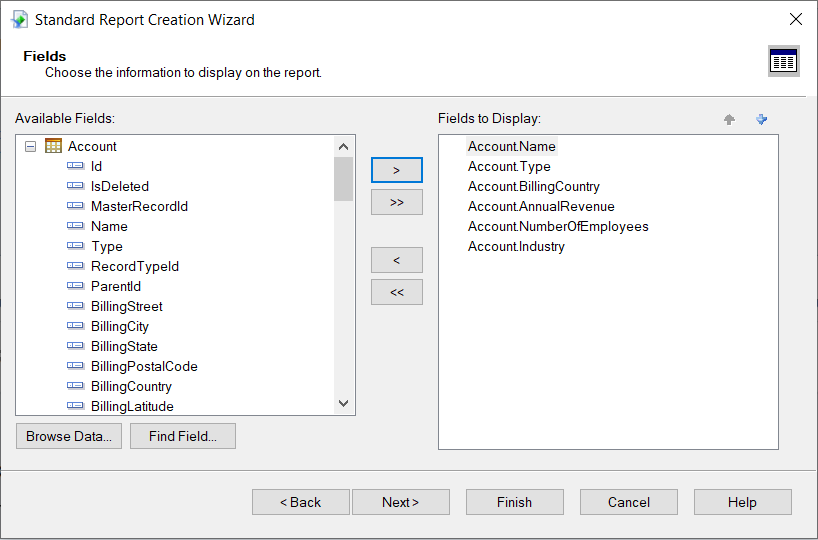

- After the tables are selected, select the fields you want displayed in the report from the selected table, followed by NEXT.

![Add the fields to display. Add the fields to display.]()

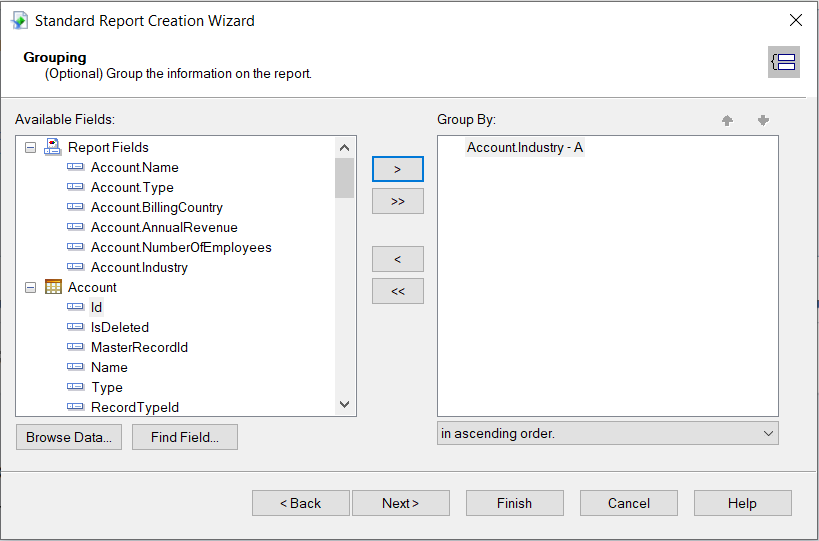

- Select the "Group By" field to group the information on the report.

![Add the Group By field. Add the Group By field.]()

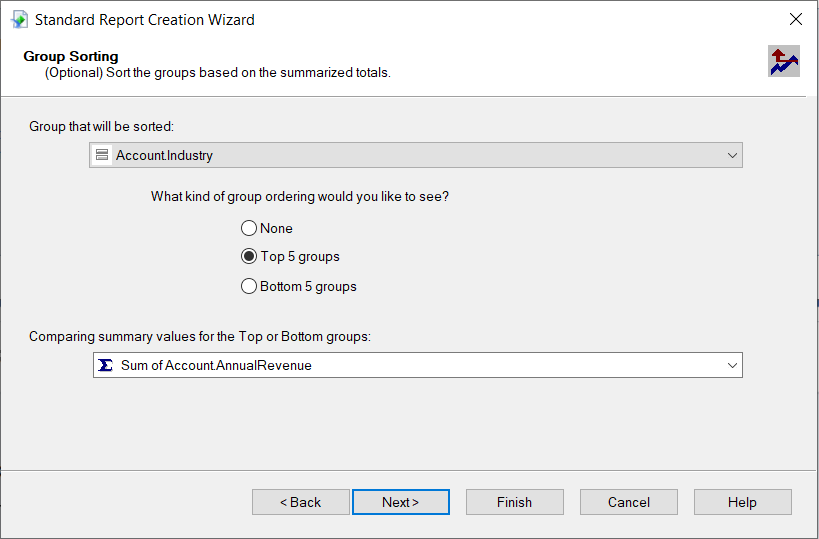

- Sort the groups based on summarised totals and click on NEXT.

![Group Sorting Group Sorting]()

For assistance constructing the JDBC URL, use the connection string designer built into the TaxJar JDBC Driver. Double-click the JAR file or execute the jar file from the command line.

java -jar cdata.jdbc.taxjar.jar

To authenticate to the TaxJar API, you will need to first obtain the API Key from the TaxJar UI.

NOTE: the API is available only for Professional and Premium TaxJar plans.

If you already have a Professional or Premium plan you can find the API Key by logging in the TaxJar UI and navigating to Account -> TaxJar API. After obtaining the API Key, you can set it in the APIKey connection property.

Additional Notes

Fill in the connection properties and copy the connection string to the clipboard.

When configuring the JDBC URL, you may also want to set the Max Rows connection property. This will limit the number of rows returned, which is especially helpful for improving performance when designing reports and visualizations.

You can then configure grouping, sorting, and summaries. See the following section to use the aggregate and summary to create a chart.

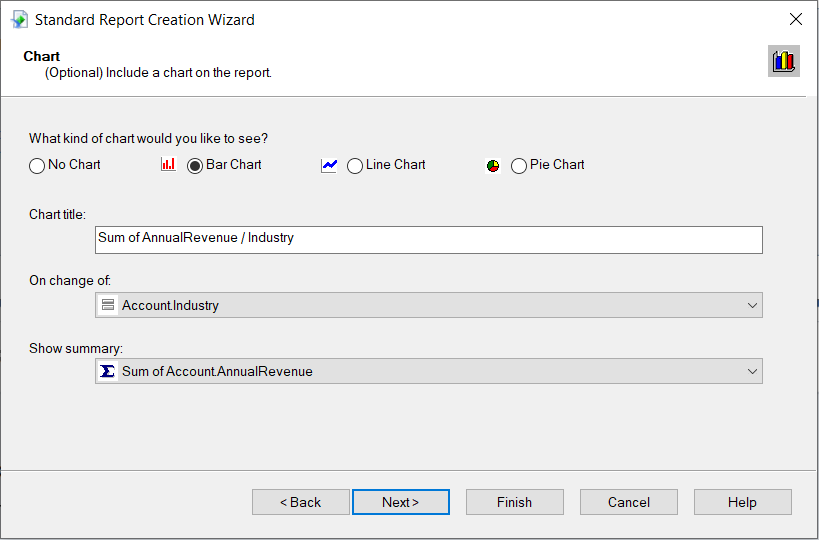

Create a Chart

After selecting a column to group by, the Standard Report Creation Wizard presents the option to create a chart. Follow the steps below to create a chart aggregating the TransactionID column's values.

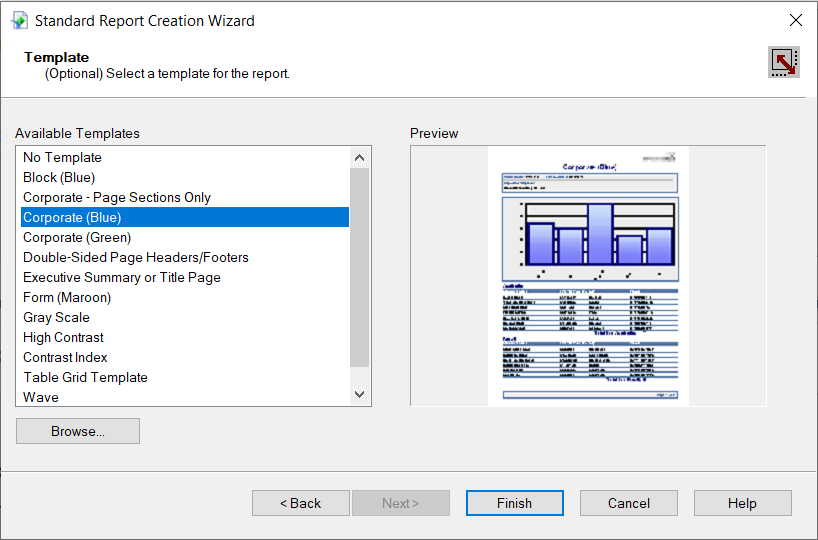

- In the Standard Report Creation Wizard, select the Bar Chart option and select the column you grouped by in the "On change of" menu.

- In the Show Summary menu, select the summary you created.

- Select filters and a template, as needed, to finish the wizard.

![Select a chart type. Select a chart type.]()

Select a template for the report to preview the finished report and view the chart populated with your data.

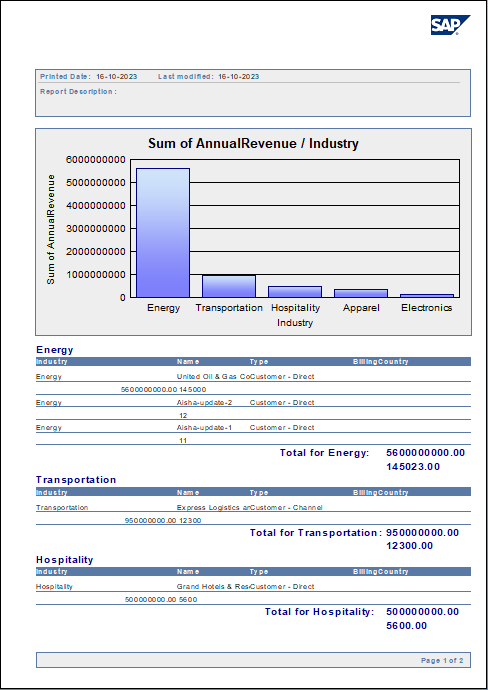

The Final Report

You can now see that the report contains all the fields initially specified.

Working with Remote Data

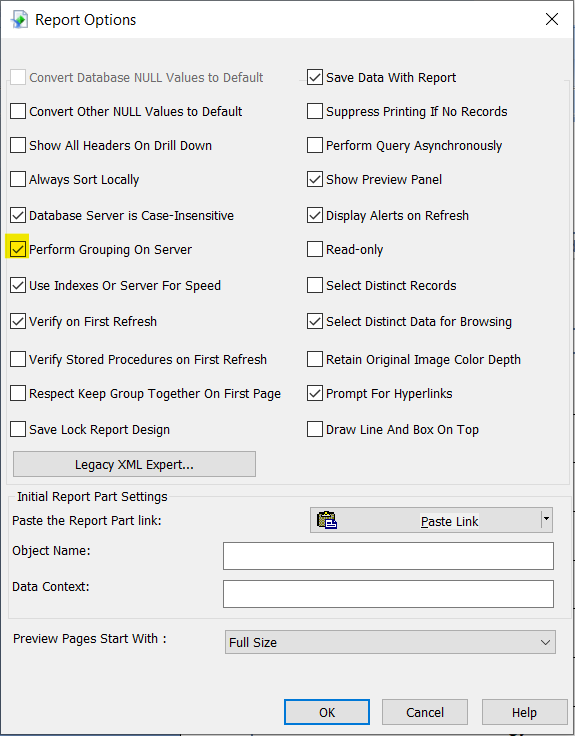

To ensure that you see updates to the data, click File and clear the "Save Data with Report" option. As you interact with the report, for example, drilling down to hidden details, Crystal Reports executes SQL queries to retrieve the data needed to display the report. To reload data you have already retrieved, refresh or rerun the report.

You can offload processing onto the driver by hiding details elements and enabling server-side grouping. To do this, you need to select a column to group by in the report creation wizard.

- Click File -> Report Options and select the "Perform Grouping On Server" option.

![Perform Grouping On Server option. Perform Grouping On Server option.]()

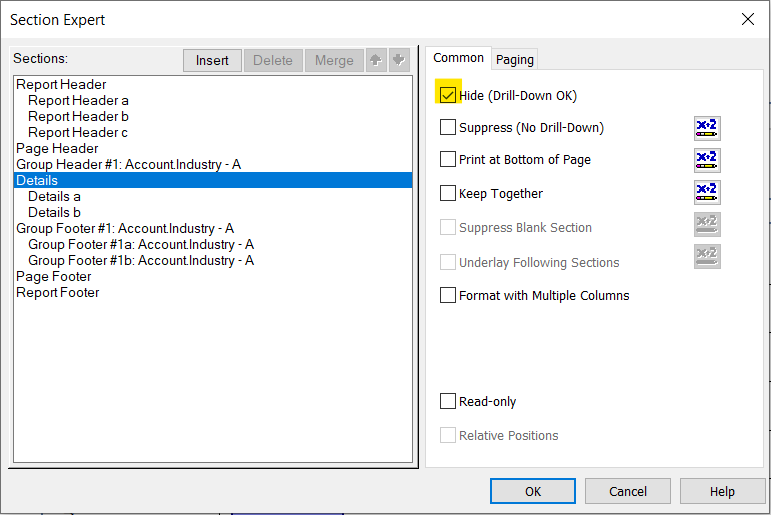

- Click Report -> Section Expert and select the Details section of your report. Select the "Hide (Drill-Down OK)" option.

![Hide (Drill-Down OK) option. Hide (Drill-Down OK) option.]()

When you preview your report with the hidden details, Crystal Reports executes a GROUP BY query. When you double-click a column in the chart to drill down to details, Crystal Reports executes a SELECT WHERE query that decreases load times by retrieving only the data needed.

At this point, you have created a SAP Crystal report built on top of live TaxJar data using SAP Crystal Reports and a CData JDBC Driver. Learn more about the CData JDBC Driver for TaxJar and download a free trial from the TaxJar JDBC Driver page. Let our Support Team know if you have any questions.