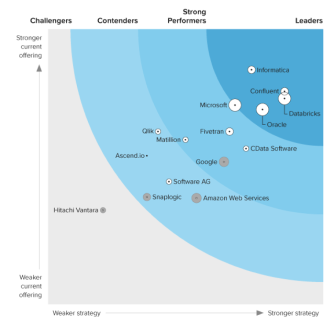

Discover how a bimodal integration strategy can address the major data management challenges facing your organization today.

Get the Report →Replicate TaxJar Data to Multiple Databases

Replicate TaxJar data to disparate databases with a point-and-click configuration.

Always-on applications rely on automatic failover capabilities and real-time access to data. CData Sync integrates live TaxJar data into your mirrored databases, always-on cloud databases, and other databases such as your reporting server: Automatically synchronize with remote TaxJar data from Windows.

Configure Replication Destinations

Using CData Sync, you can replicate TaxJar data to any number of databases, both cloud-based and on-premises. To add a replication destination, navigate to the Connections tab.

For each destination database:

- Click Add Connection.

- Select a destination. In this article, we use SQLite.

![Configure a Destination connection.]()

- Enter the necessary connection properties. To replicate TaxJar to a SQLite database, enter a file path in the Data Source box.

- Click Test Connection to ensure that the connection is configured properly.

![Configure a Destination connection (SQLite is shown).]()

- Click Save Changes.

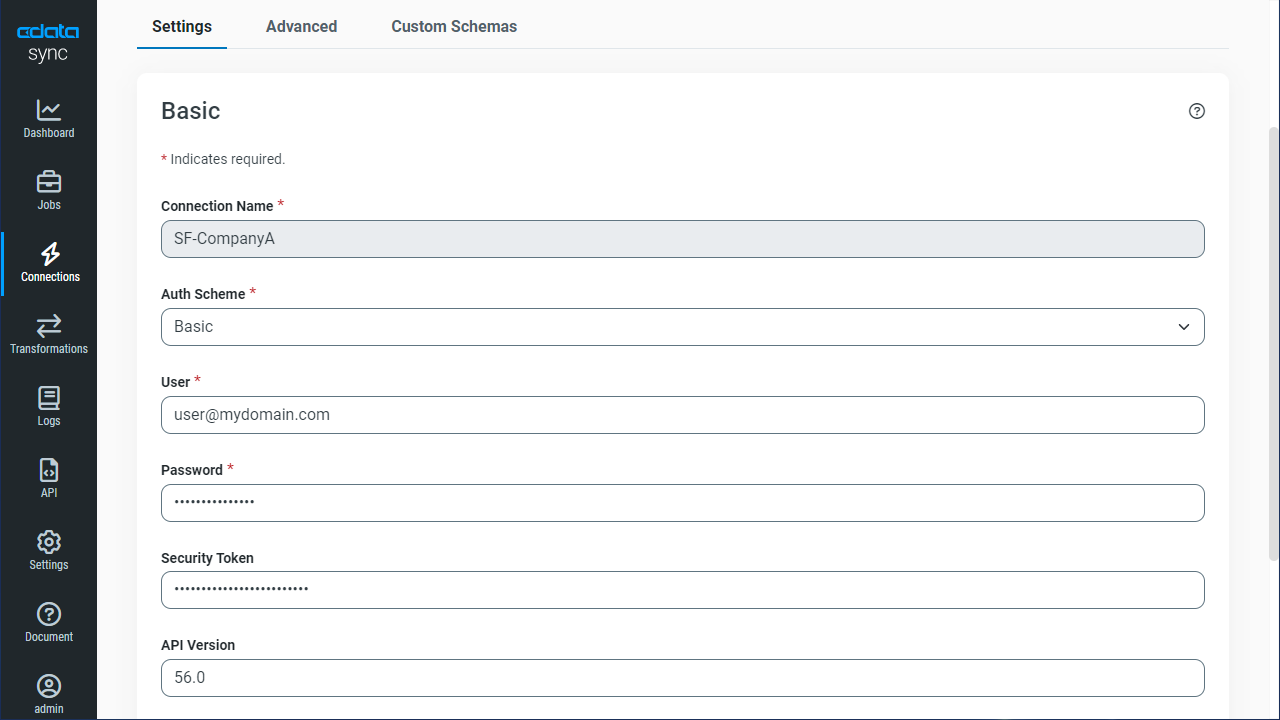

Configure the TaxJar Connection

You can configure a connection to TaxJar from the Connections tab. To add a connection to your TaxJar account, navigate to the Connections tab.

- Click Add Connection.

- Select a source (TaxJar).

- Configure the connection properties.

To authenticate to the TaxJar API, you will need to first obtain the API Key from the TaxJar UI.

NOTE: the API is available only for Professional and Premium TaxJar plans.

If you already have a Professional or Premium plan you can find the API Key by logging in the TaxJar UI and navigating to Account -> TaxJar API. After obtaining the API Key, you can set it in the APIKey connection property.

Additional Notes

- By default, the CData connector will retrieve data of the last 3 months in cases where the entity support date range filtering. You can set StartDate to specify the minimum creation date of the data retrieved.

- If the API Key has been created for a sandbox API account please set UseSandbox to true, but not all endpoints will work as expected. For more information, refer to the TaxJar developer documentation.

![Configure a Source connection (Salesforce is shown).]()

- Click Connect to ensure that the connection is configured properly.

- Click Save Changes.

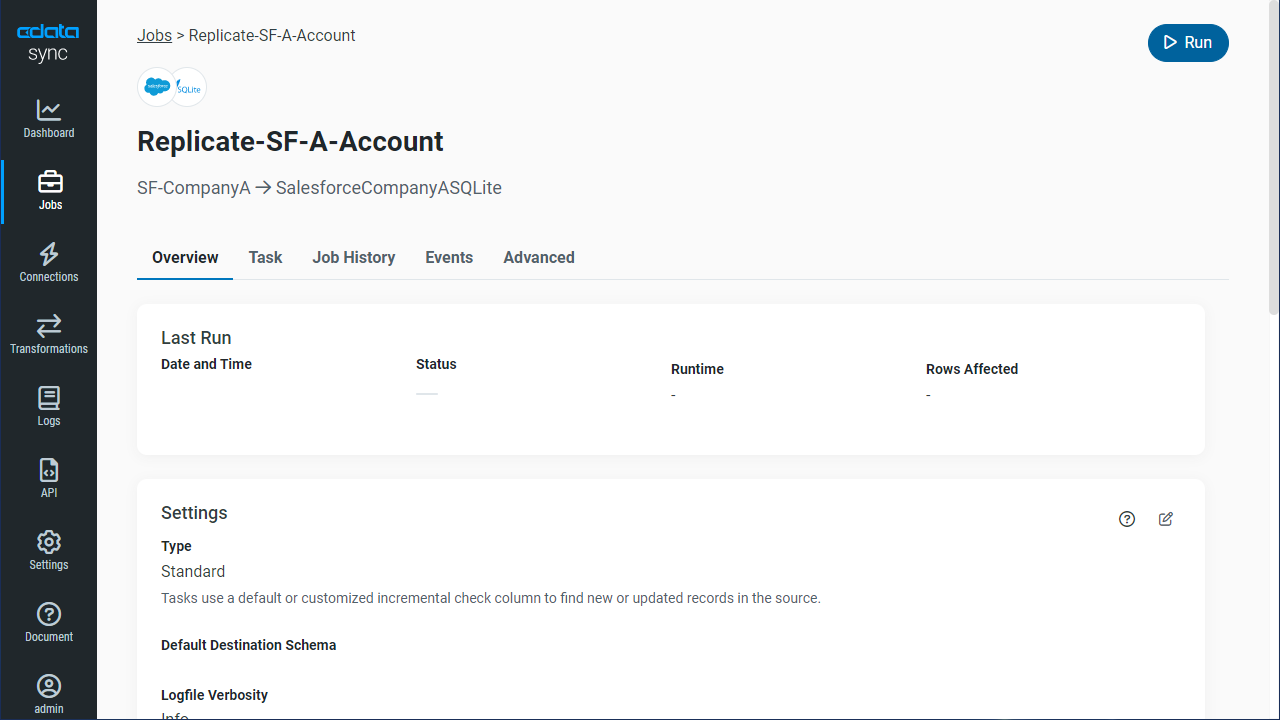

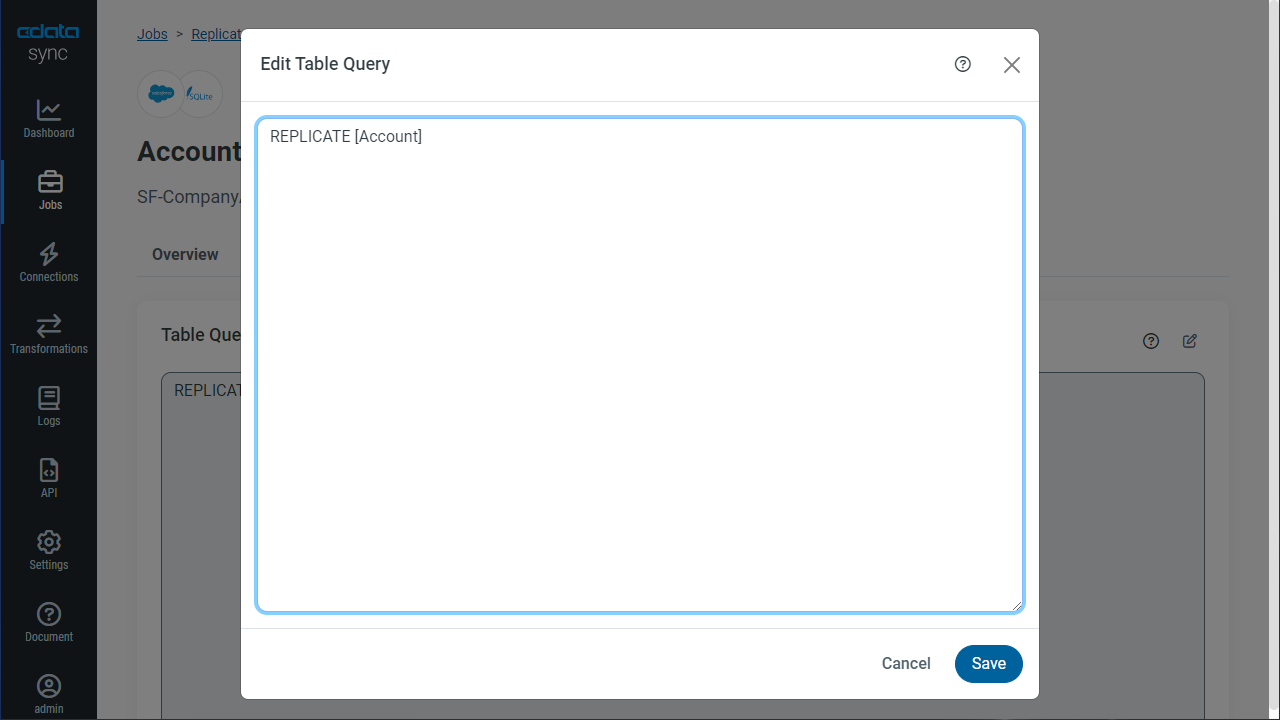

Configure Replication Queries

CData Sync enables you to control replication with a point-and-click interface and with SQL queries. For each replication you wish to configure, navigate to the Jobs tab and click Add Job. Select the Source and Destination for your replication.

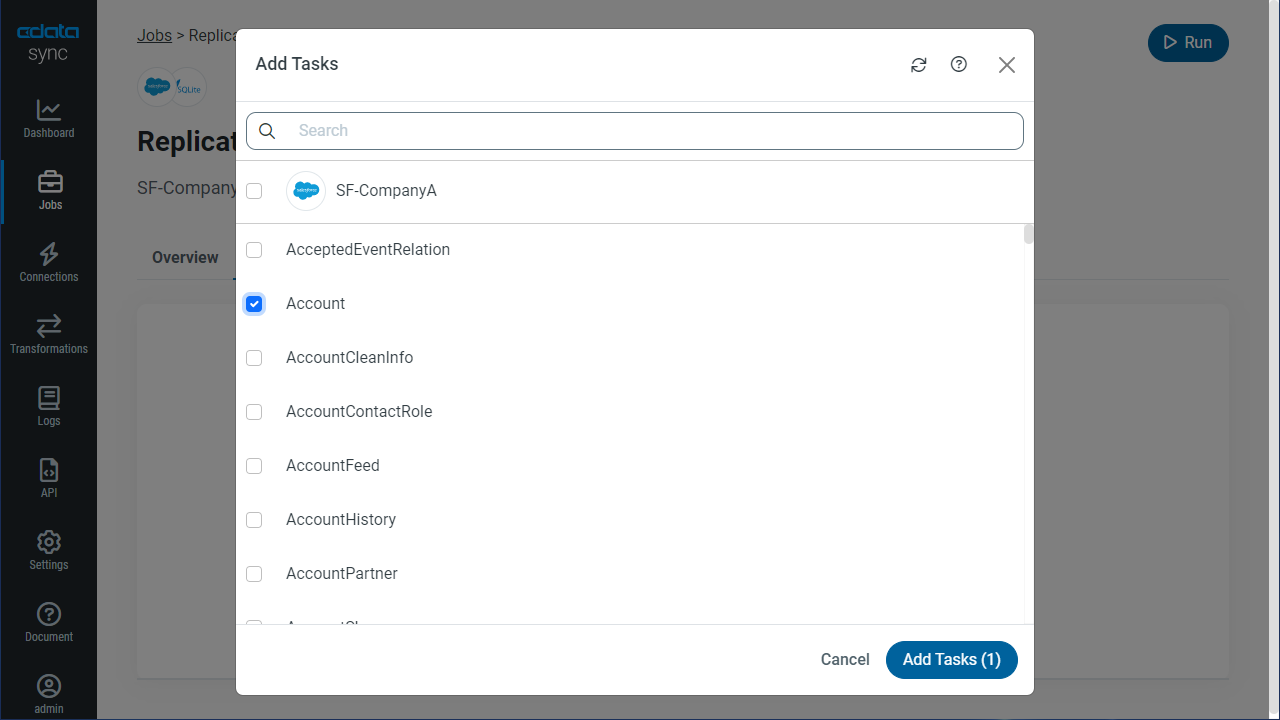

Replicate Entire Tables

To replicate an entire table, click Add Tables in the Tables section, choose the table(s) you wish to replicate, and click Add Selected Tables.

Customize Your Replication

You can use a SQL query to customize your replication. The REPLICATE statement is a high-level command that caches and maintains a table in your database. You can define any SELECT query supported by the TaxJar API. To customize your replication, click Add Custom Query in the Tables section and define the Query Statement.

The statement below caches and incrementally updates a table of TaxJar data:

REPLICATE Orders;

You can specify a file containing the replication queries you want to use to update a particular database. Separate replication statements with semicolons. The following options are useful if you are replicating multiple TaxJar accounts into the same database:

-

Use a different table prefix in the REPLICATE SELECT statement:

REPLICATE PROD_Orders SELECT * FROM Orders; -

Alternatively, use a different schema:

REPLICATE PROD.Orders SELECT * FROM Orders;

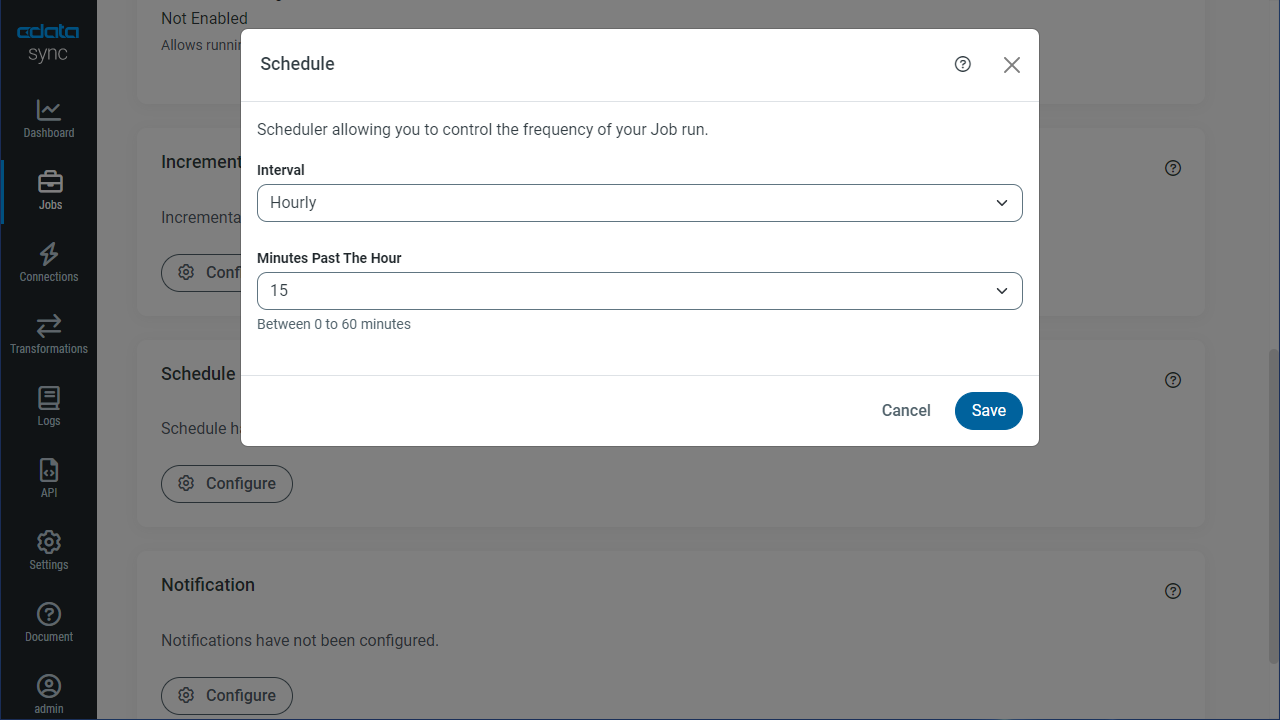

Schedule Your Replication

In the Schedule section, you can schedule a job to run automatically, configuring the job to run after specified intervals ranging from once every 10 minutes to once every month.

Once you have configured the replication job, click Save Changes. You can configure any number of jobs to manage the replication of your TaxJar data to disparate on-premises, cloud-based, and other databases.