Discover how a bimodal integration strategy can address the major data management challenges facing your organization today.

Get the Report →Automate Tasks in Power Automate Using the CData API Server and TaxJar ADO.NET Provider

Automate actions like sending emails to a contact list, posting to social media, or syncing CRM and ERP.

Power Automate (Microsoft Flow) makes it easy to automate tasks that involve data from multiple systems, on premises or in the cloud. With the CData API Server and TaxJar ADO.NET Provider (or any of 200+ other ADO.NET Providers), line-of-business users have a native way to create actions based on TaxJar triggers in Power Automate; the API Server makes it possible for SaaS applications like Power Automate to integrate seamlessly with TaxJar data through data access standards like Swagger and OData. This article shows how to use wizards in Power Automate and the API Server for TaxJar to create a trigger -- entities that match search criteria -- and send an email based on the results.

Set Up the API Server

Follow the steps below to begin producing secure and Swagger-enabled TaxJar APIs:

Deploy

The API Server runs on your own server. On Windows, you can deploy using the stand-alone server or IIS. On a Java servlet container, drop in the API Server WAR file. See the help documentation for more information and how-tos.

The API Server is also easy to deploy on Microsoft Azure, Amazon EC2, and Heroku.

Connect to TaxJar

After you deploy, provide authentication values and other connection properties by clicking Settings -> Connections in the API Server administration console. You can then choose the entities you want to allow the API Server access to by clicking Settings -> Resources.

To authenticate to the TaxJar API, you will need to first obtain the API Key from the TaxJar UI.

NOTE: the API is available only for Professional and Premium TaxJar plans.

If you already have a Professional or Premium plan you can find the API Key by logging in the TaxJar UI and navigating to Account -> TaxJar API. After obtaining the API Key, you can set it in the APIKey connection property.

Additional Notes

- By default, the CData connector will retrieve data of the last 3 months in cases where the entity support date range filtering. You can set StartDate to specify the minimum creation date of the data retrieved.

- If the API Key has been created for a sandbox API account please set UseSandbox to true, but not all endpoints will work as expected. For more information, refer to the TaxJar developer documentation.

You will also need to enable CORS and define the following sections on the Settings -> Server page. As an alternative, you can select the option to allow all domains without '*'.

- Access-Control-Allow-Origin: Set this to a value of '*' or specify the domains that are allowed to connect.

- Access-Control-Allow-Methods: Set this to a value of "GET,PUT,POST,OPTIONS".

- Access-Control-Allow-Headers: Set this to "x-ms-client-request-id, authorization, content-type".

Authorize API Server Users

After determining the OData services you want to produce, authorize users by clicking Settings -> Users. The API Server uses authtoken-based authentication and supports the major authentication schemes. You can authenticate as well as encrypt connections with SSL. Access can also be restricted by IP address; access is restricted to only the local machine by default.

For simplicity, we will allow the authtoken for API users to be passed in the URL. You will need to add a setting in the Application section of the settings.cfg file, located in the data directory. On Windows, this is the app_data subfolder in the application root. In the Java edition, the location of the data directory depends on your operation system:

- Windows: C:\ProgramData\CData

- Unix or Mac OS X: ~/cdata

[Application]

AllowAuthtokenInURL = true

Add TaxJar Data to a Flow

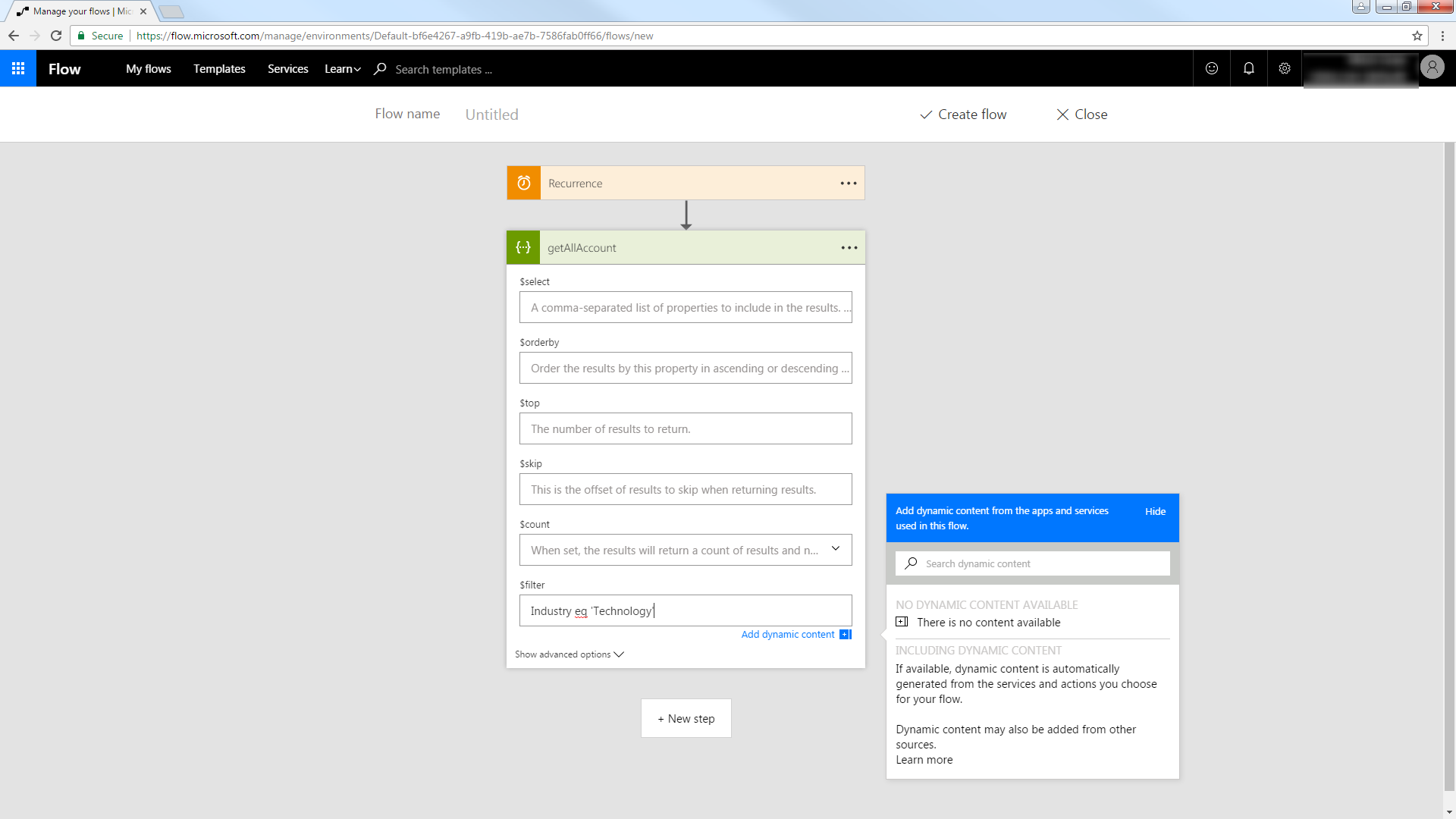

You can use the built-in HTTP + Swagger connector to use a wizard to design a TaxJar process flow:

- In Power Automate, click My Flows -> Create from Blank.

- Select the Recurrence action and select a time interval for sending emails. This article uses 1 day.

- Add an HTTP + Swagger action by searching for Swagger.

- Enter the URL to the Swagger metadata document:

https://MySite:MyPort/api.rsc/@MyAuthtoken/$oas - Select the "Return Orders" operation.

Build the OData query to retrieve TaxJar data. This article defines the following OData filter expression in the $filter box:

TransactionID eq '123'

See the API Server help documentation for more on filtering and examples of the supported OData.

Trigger an Action

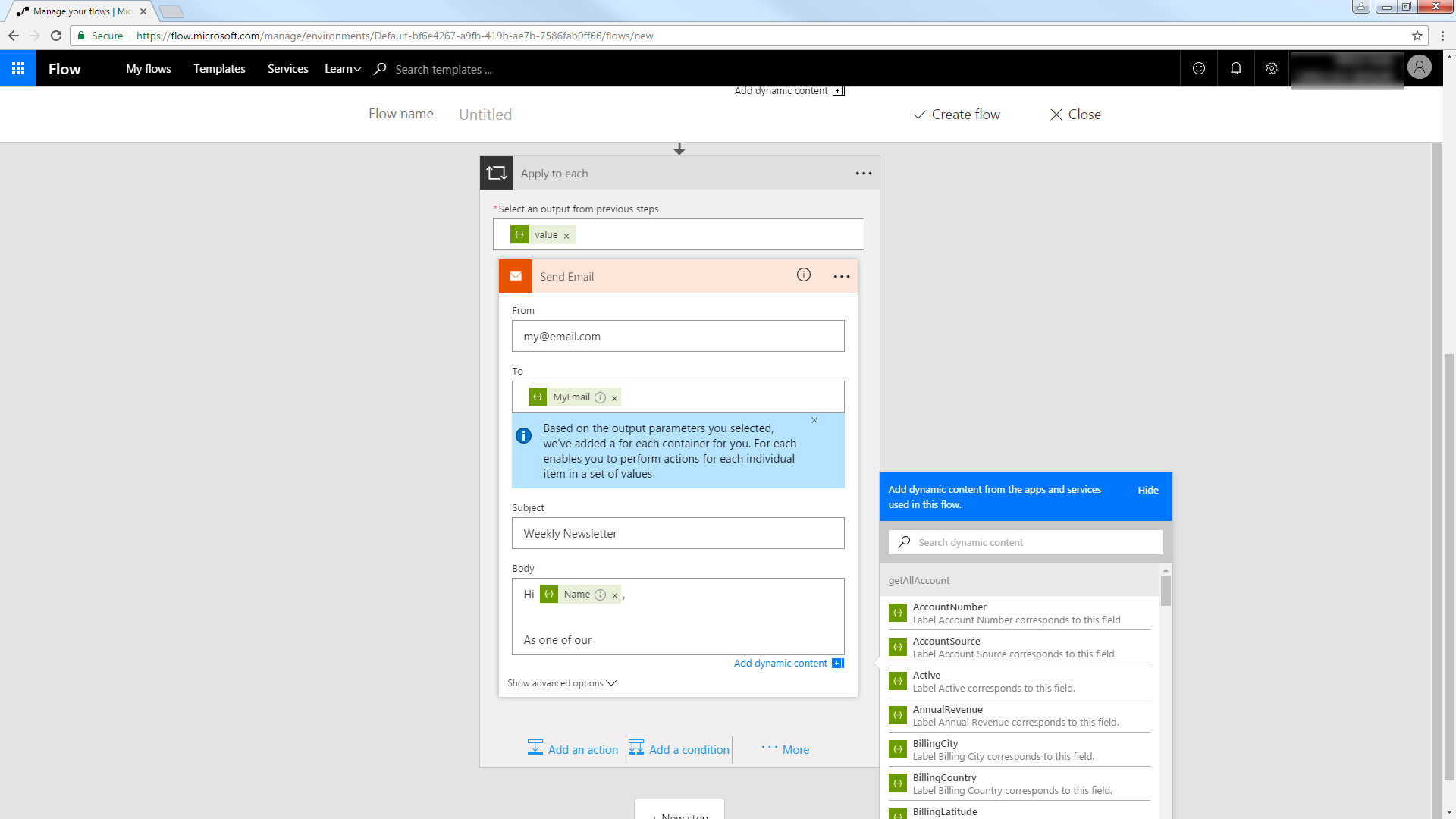

You can now work with Orders entities in your process flow. Follow the steps to send an automated email:

- Add an SMTP - Send Email action.

- Enter the address and credentials for the SMTP server and name the connection. Be sure to enable encryption if supported by your server.

- Enter the message headers and body. You can add TaxJar columns in these boxes.

![An email to be populated with results from an OData query. (Salesforce is shown.)]()