Discover how a bimodal integration strategy can address the major data management challenges facing your organization today.

Get the Report →Use the CData ODBC Driver for TaxJar in SAS for Real-Time Reporting and Analytics

Connect to real-time TaxJar data in SAS for reporting, analytics, and visualizations using the CData ODBC Driver for TaxJar.

SAS is a software suite developed for advanced analytics, multivariate analysis, business intelligence, data management, and predictive analytics. When you pair SAS with the CData ODBC Driver for TaxJar, you gain database-like access to live TaxJar data from SAS, expanding your reporting and analytics capabilities. This articles walks through creating a library for TaxJar in SAS and creating a simple report based on real-time TaxJar data.

The CData ODBC Driver offers unmatched performance for interacting with live TaxJar data in SAS due to optimized data processing built into the driver. When you issue complex SQL queries from SAS to TaxJar, the driver pushes supported SQL operations, like filters and aggregations, directly to TaxJar and utilizes the embedded SQL engine to process unsupported operations (often SQL functions and JOIN operations) client-side. With built-in dynamic metadata querying, you can easily visualize and analyze TaxJar data in SAS.

Connect to TaxJar as an ODBC Data Source

Information for connecting to TaxJar follows, along with different instructions for configuring a DSN in Windows and Linux environments (the ODBC Driver for TaxJar must be installed on the machine hosting the SAS System).

To authenticate to the TaxJar API, you will need to first obtain the API Key from the TaxJar UI.

NOTE: the API is available only for Professional and Premium TaxJar plans.

If you already have a Professional or Premium plan you can find the API Key by logging in the TaxJar UI and navigating to Account -> TaxJar API. After obtaining the API Key, you can set it in the APIKey connection property.

Additional Notes

- By default, the CData connector will retrieve data of the last 3 months in cases where the entity support date range filtering. You can set StartDate to specify the minimum creation date of the data retrieved.

- If the API Key has been created for a sandbox API account please set UseSandbox to true, but not all endpoints will work as expected. For more information, refer to the TaxJar developer documentation.

When you configure the DSN, you may also want to set the Max Rows connection property. This will limit the number of rows returned, which is especially helpful for improving performance when designing reports and visualizations.

Windows

If you have not already, first specify connection properties in an ODBC DSN (data source name). This is the last step of the driver installation. You can use the Microsoft ODBC Data Source Administrator to create and configure ODBC DSNs.

Linux

If you are installing the CData ODBC Driver for TaxJar in a Linux environment, the driver installation predefines a system DSN. You can modify the DSN by editing the system data sources file (/etc/odbc.ini) and defining the required connection properties.

/etc/odbc.ini

[CData TaxJar Sys]

Driver = CData ODBC Driver for TaxJar

Description = My Description

APIKey = 3bb04218ef8t80efdf1739abf7257144

For specific information on using these configuration files, please refer to the help documentation (installed and found online).

Create a TaxJar Library in SAS

Connect to TaxJar in SAS by adding a library based on the CData ODBC Driver for TaxJar.

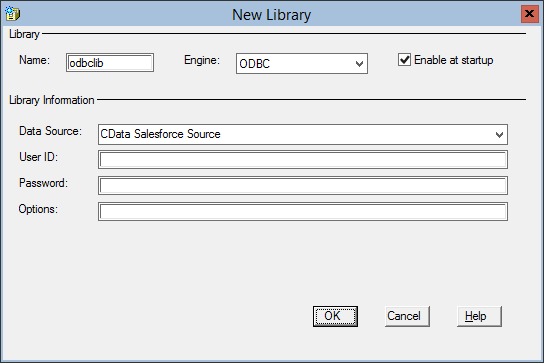

- Open SAS and expand Libraries in the Explorer pane.

- In the Active Libraries window, right-click and select New.

- Name your library (odbclib), select ODBC as the Engine, and click to Enable at startup (if you want the library to persist between sessions).

- Set Data Source to the DSN you previously configured and click OK.

![Creating a library for TaxJar in SAS.]()

Create a View from a TaxJar Query

SAS natively supports querying data either using a low-code, point-and-click Query tool or programmatically with PROC SQL and a custom SQL query. When you create a View in SAS, the defining query is executed each time the view is queried. This means that you always query live TaxJar data for reports, charts, and analytics.

Using the Query Tool

- In SAS, click Tools -> Query

- Select the table sources and the table(s) you wish to pull data from. Then, click OK.

![Selecting table(s) to visualize.]()

- Select columns and right-click to add filtering, ordering, grouping, etc.

![Selecting columns(s) to visualize and configuring the query.]()

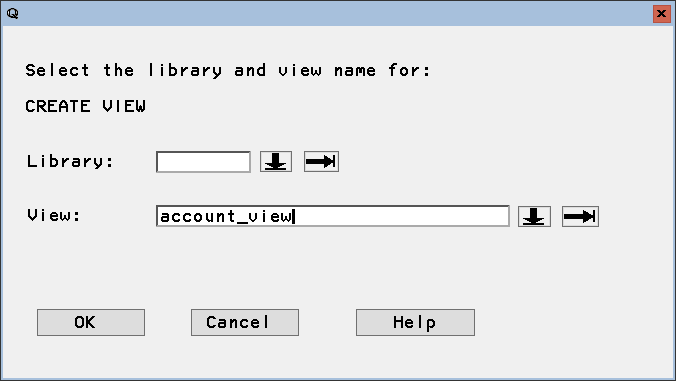

- Create a local view to contain the query results by right-clicking the SQL Query Tool window, selecting Show Query, and clicking Create View. Name the View and click OK.

![Create a local view to work with TaxJar data.]()

Using PROC SQL

- In SAS, navigate to the Editor window.

- Use PROC SQL to query the data and create a local view.

NOTE: This procedure creates a view in the Work library. You can optionally specify a library in the create view statement.proc sql; create view orders_view as select transactionid, userid from odbclib.orders where TransactionID = '123'; quit; - Click Run -> Submit to execute the query and create a local view.

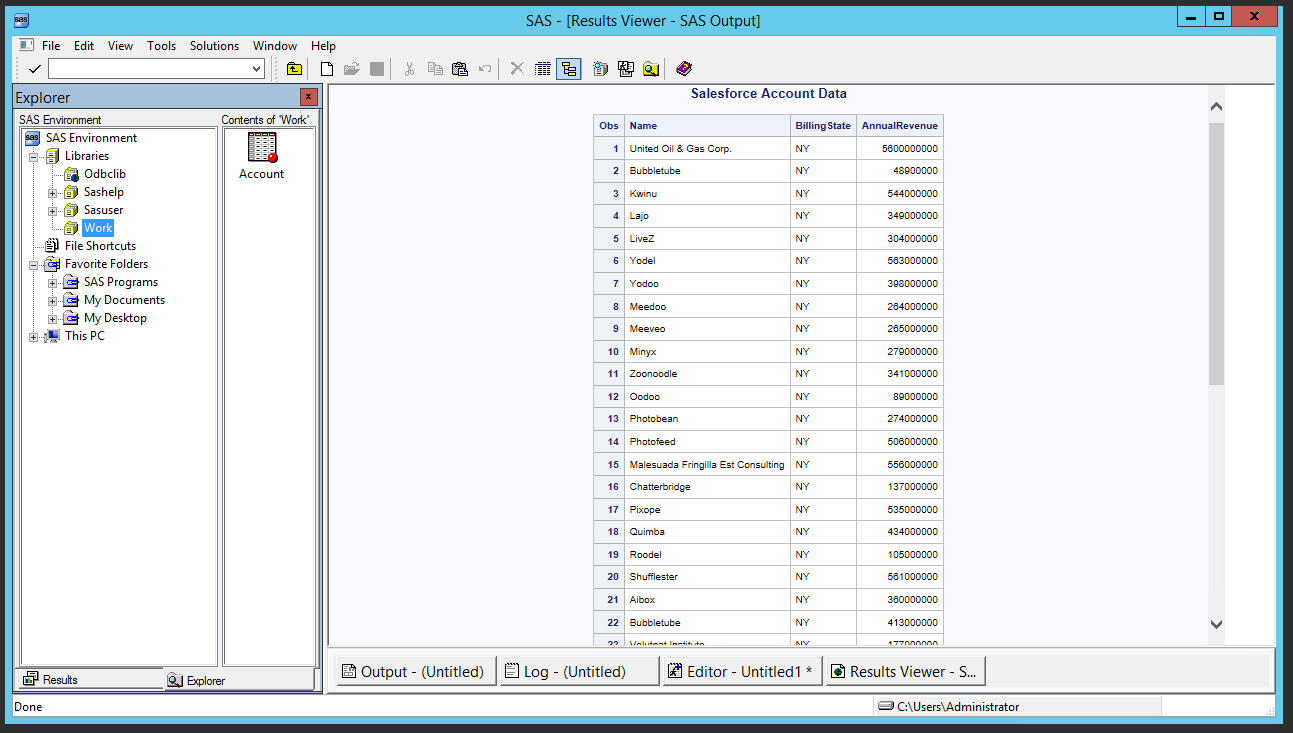

Report On or Visualize TaxJar Data in SAS

With a local view created, you can report, visualize, or otherwise analyze TaxJar data using the powerful SAS features. Print a simple report using PROC PRINT and create a basic graph based on the data using PROC GCHART.

Print an HTML Report

- In SAS, navigate to the Editor window.

- Use PROC PRINT to print an HTML report for the TaxJar Orders data.

proc print data=orders; title "TaxJar Orders Data"; run;

![A simple TaxJar data report.]()

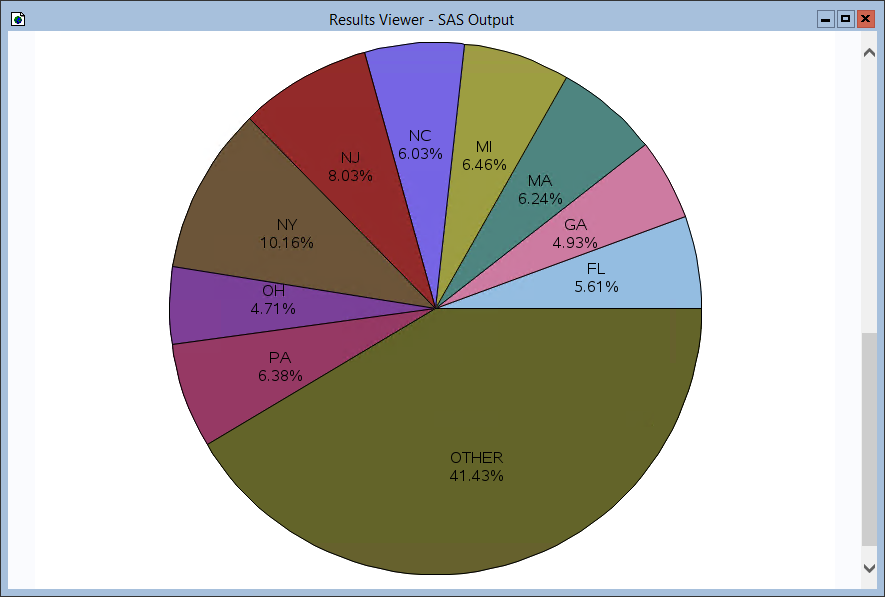

Print a Chart

- In SAS, navigate to the Editor window.

- Use PROC GCHART to create a chart for the Orders data.

proc gchart data=orders; pie transactionid / sumvar=userid value=arrow percent=arrow noheading percent=inside plabel=(height=12pt) slice=inside value=none name='OrdersChart'; run;![A simple TaxJar data chart.]()